Mortgages and Mortgage Complaints

The CFPB’s Consumer Complaint Database Gets Real Results for Victims of Mortgage Problems

Our sixth report analyzing complaints in the CFPB's Public Consumer Complaint Database evaluates mortgage complaints, the number one source of complaints to the CFPB, totaling 38% of nearly 500,000 complaints posted since 2011.

Executive Summary

The Consumer Financial Protection Bureau (CFPB) was established in 2010 in the wake of the worst financial crisis in decades. Its mission is to identify dangerous and unfair financial practices, to educate consumers about these practices and to regulate the financial institutions that perpetuate them.

To help accomplish these goals, the CFPB has created and made available to the public the Consumer Complaint Database. The database tracks complaints made by consumers to the CFPB and how they are resolved. The Consumer Complaint Database enables the CFPB to identify financial practices that threaten to harm consumers, and it enables the public to evaluate both the performance of the financial industry and of the CFPB.

This is the sixth in a series of reports that review complaints to the CFPB nationally and on a state-by-state level. In this report we explore consumer complaints about mortgages, with the aim of uncovering patterns in the problems consumers are experiencing with mortgage originators and servicers.

This report looks at total mortgage complaints. It looks at complaint volumes over time and among the six mortgage issues that the CFPB defines. These issues include the following:

- problems when consumers are unable to pay

- problems consumers have making payments

- applying for the loan

- signing the agreement

- receiving a credit offer

- other problems

We also compare companies and complaints on a state by state and total basis.

Findings:

Consumer complaints about mortgages are the most common complaint in the CFPB’s database. Since it began accepting mortgage complaints in December 2011, the CFPB has published 138,086 complaints about mortgages, the most complaints received about any financial product.

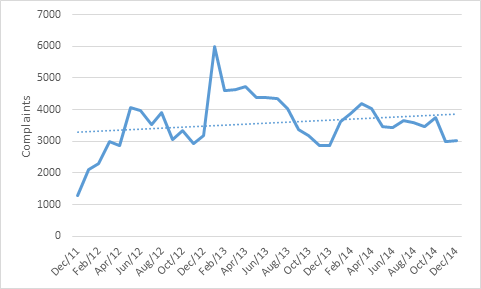

Through March 16, 2015, 38% of all published complaints in the database were mortgage complaints. Although annual mortgage complaint volumes declined slightly in 2014 as the volume of the CFPB’s 10 other product complaint categories (i.e. debt collection, credit reporting, credit card, bank account or service, consumer loan, student loan, payday loan, money transfers, prepaid card, and other financial services) continued to grow, data are insufficient to predict a declining trend. (See Figure ES-1 and Table ES-1.)

Figure ES-1. Consumer Complaints about Mortgages over Time

In early 2015, debt collection complaints became the #1 complaint to be published in the CFPB’s database on a monthly basis. Mortgage complaints, however, remain at #2 on a monthly basis and are still the #1 complaint overall.

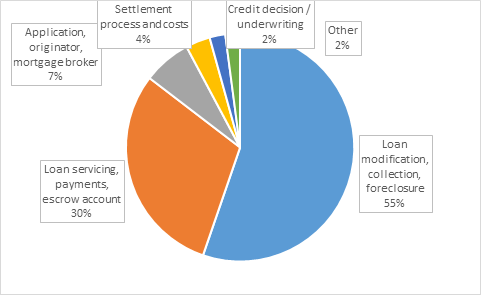

The vast majority of mortgage complaints (85%) fall into two issue categories: Problems when consumers are unable to pay (categorized in the database as “loan modification, collection, foreclosure”) make up 55% of the total; problems making payments (categorized in the database as “loan servicing, payments and escrow account”) make up 30%. The other four issue categories total 15%. (See Figure ES-2.)

Figure ES-2. Breakdown of Complaints by Issue

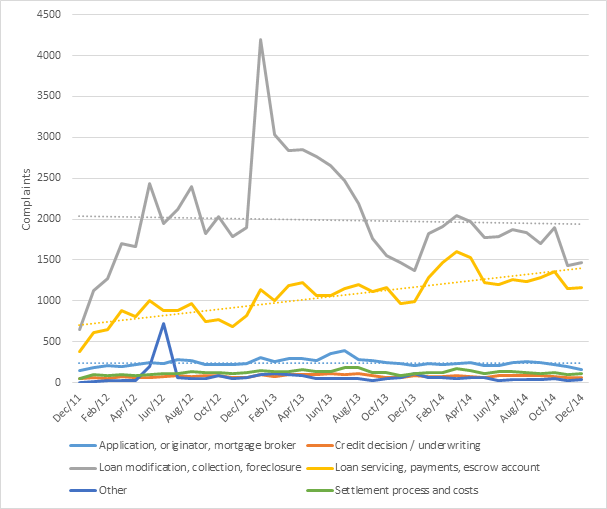

Five out of the six mortgage issues declined in volume. One issue, complaints related to making payments (loan serving, payments, escrow account complaints) , continues to increase. (See Figure ES-3.) Such complaints increased by 19% in 2014, compared to 2013. The CFPB says that payment related complaints include loan servicing, payments and escrow accounts.

Figure ES-3. Consumer Complaints about Mortgages by Issue over Time

Ten companies account for 77% of all mortgage complaints to the CFPB: Bank of America, Wells Fargo, Ocwen, JPMorgan Chase, Nationstar Mortgage, Citibank, Green Tree Servicing, HSBC, U.S. Bancorp, and PNC Bank.

- Bank of America has the most total mortgage complaints with 31,123, making up about 23% of all mortgage complaints.

- Bank of America was the most complained about company in 45 states and the District of Columbia. Wells Fargo was complained about the most in five states.

- When adjusted for market share, the three most complained about companies are Ocwen, Nationstar Mortgage, and Bank of America, in that order.

Recommendations:

The Consumer Complaint Database is an essential tool in the effort to protect consumers from deceptive and abusive practices in the financial marketplace. The CFPB has acted on recommendations we have made in previous reports to improve the quality of the Consumer Complaint Database and the effectiveness of the bureau. We commend the CFPB for:

- Adding complaint narratives to the database. In March 2015, the CFPB started allowing consumers to opt into publicly sharing the details of their complaints in the database. The first 7,700 narratives were published on June 25, 2015. No personally identifiable information, including demographic details, is being shared publicly.

- Adding new complaint categories: Complaints about prepaid cards, other consumer loans (i.e. pawn and title loans), and other financial services (i.e. credit repair and debt settlement) were added to the database in January 2015.

Topics

Find Out More

5 steps you can take to protect your privacy now

Too much to recall