Tax & budget

Together we can make sure tax and budget decisions reflect our shared priorities and balance competing values.

Featured Resources

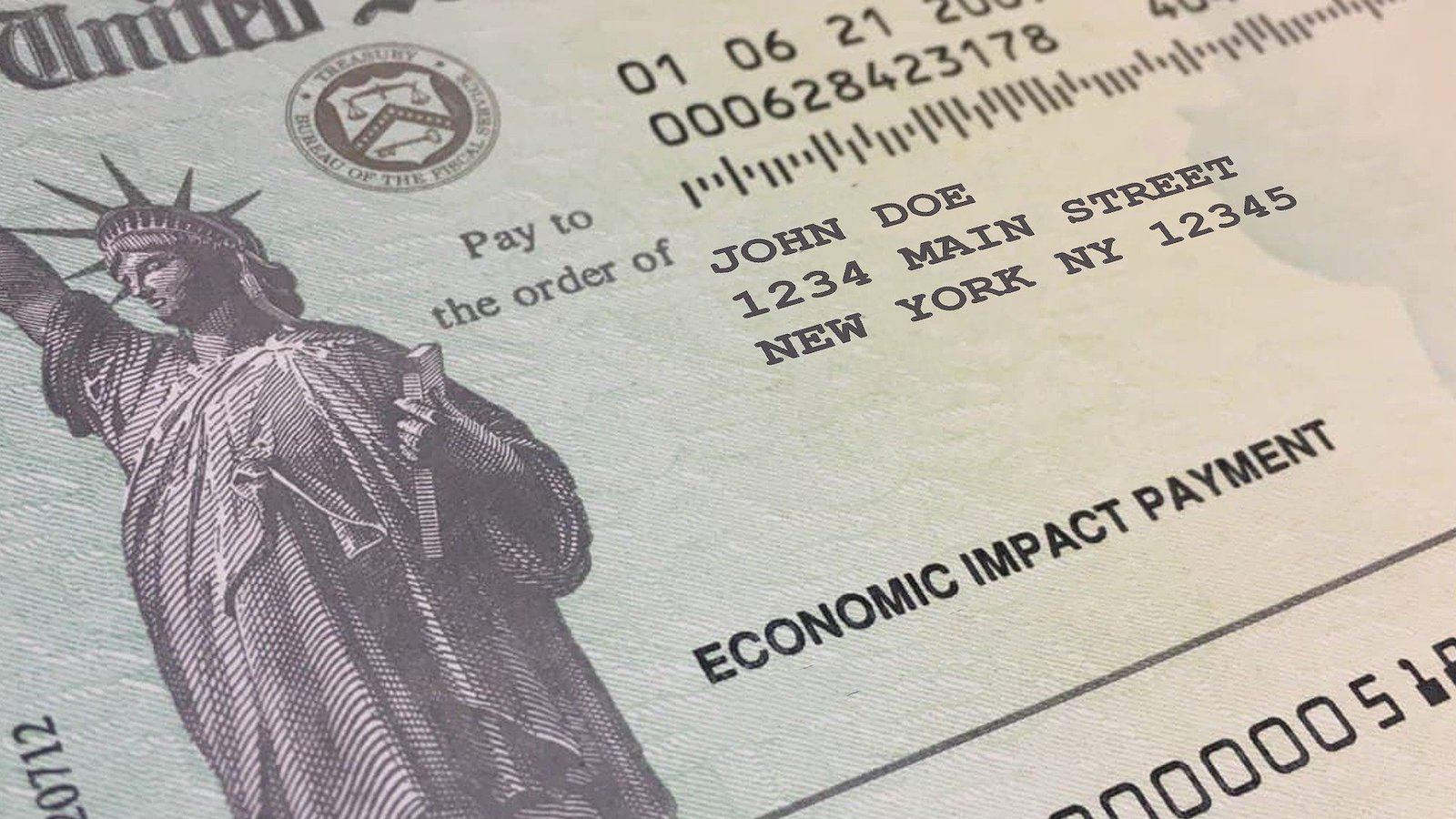

How to get your stimulus payments when you file your tax return

Fraudulent unemployment claims: You could be next — here’s what to do